You've Got Questions? We've Got Answers.

Below you will find a host of commonly asked questions and answers sorted by category. If you can’t find what you’re looking for, please give us a call at (360) 754-3400 or Contact Customer Service.

Categories

Digital Banking

How do I remove my Online and Mobile Banking access?

If you wish to terminate your access to the OlyFed Online and Mobile Banking system and delete your Online and Mobile Banking user account, you may call Olympia Federal Savings at (360) 754-3400 or 1-800-865-3470, or send a letter to:

Olympia Federal Savings

Attention: Online Banking

P.O. Box 1338

Olympia, WA 98507-1338

How many months of eStatements are available to me for review in digital banking?

eStatements will be available within online banking for a rolling five-year period from the most recent statement. To view your statement, navigate to Services > eStatements.

How do I set my statement delivery preferences?

To update your statement delivery preferences, login to online banking and navigate to Services > Statement Delivery.

How do I review my credit score?

SavvyMoney™ is a tool to keep track of credit score reports and provides credit monitoring, alerts, personalized offers and expert insight on how to improve and strengthen your credit. It is a free service provided to our customers through our digital banking platform.

Utilizing VantageScore 3.0 from Transunion, you’re able to check your credit score anytime and anywhere to help you make better financial decisions. Utilizing the services will never directly impact your credit score. When accessing your credit file information, it results in a “soft inquiry” that doesn’t alter your score in any way.

Utilizing VantageScore 3.0 from Transunion, you’re able to check your credit score anytime and anywhere to help you make better financial decisions. Utilizing the services will never directly impact your credit score. When accessing your credit file information, it results in a “soft inquiry” that doesn’t alter your score in any way.

Customers can enable this feature by clicking on “Credit Score” within the left-hand Main Menu or by clicking on the widget on the right-hand side of the screen. This feature is available for both desktop and mobile users.

Questions? Email us, call (360) 754-3400 or visit a branch.

How do I complete an internal transfer online?

- Log in to digital banking.

- Navigate to Transactions > Funds Transfer.

- Use the from and to drop-downs to choose the accounts to send and receive the funds.

- Enter an amount to transfer.

- Click Transfer Funds.

Internal Transfer Limits: Unlimited

NOTE: Funds transfer activity can be review in the Digital Activity Center under Transactions.

Can I transfer to another OlyFed customer online?

Yes, we now offer Customer to Customer transfers.

- Log in to digital banking.

- Navigate to Transactions > Customer to Customer.

- To add a customer that you will routinely transfer to click Link Account, for a one-time transfer select Single Transfer.

Link Account

- Enter the recipient’s email and the last four of their account number.

- Click Submit.

Note: This account will now appear in Transactions > Funds Transfer.

Single Transfer

- Select the account to pay from.

- Enter the amount of the transfer.

- Enter the recipient’s email.

- Enter the last four of the receiver’s account number.

- Click Submit.

What is a linked account?

Linked accounts allow you to view activity across multiple financial institutions, credit card companies and brokerages. This information is used within our financial and budget tools to help you manage your money in one place.

NOTE: Linked accounts are view only and cannot conduct transactions. To conduct transactions navigate to Services > Add External Account.

Why is my phone number required for login?

“Secure Access Codes” are required to access your accounts via online banking for the first time from any new device. This code is delivered to you via mobile text message, phone call or email. If we do not have your correct information, we will not be able to send you your secure access code. Contact Digital Services (360) 596-9512 to update your contact information.

What browser version do I need for digital banking?

The following web browsers are supported by digital banking:

Microsoft Edge or higher

Mozilla Firefox 56 or higher

Google Chrome 62 or higher

Safari 10 or higher

Microsoft Internet Explorer 11 or earlier and Microsoft Windows XP are not supported.

How do I hide or display an account?

- Within online banking, navigate to Settings > Account Preferences

- Next to the account, slide the button to Home to make it visible, slide to Off to disable.

How do I nickname an account?

- Click on the stacked dot icon and select Nickname.

- Enter the new name in the box and click the check mark.

How do I group accounts in digital banking?

You can organize your internal and linked accounts into groups, so the home page appears in a way that makes sense to you. These groups can always be changed or deleted to meet your needs.

- Create a new group by clicking and holding an account tile, then dragging and dropping it into the pop-up icon that looks like an envelope.

- Create a group nickname and click the checkmark when you are finished.

To Update a Group Name

- Click the pencil icon to edit your group nickname.

- Enter a new name and click the checkmark when you are finished.

How do I add an external account so I can make transfers?

- Login to digital banking.

- Navigate to Services > Add External Account.

- Enter the account number.

- Select the type of account using Account Type drop-down.

- Enter the financial institution’s routing number. These numbers are located at the bottom of a paper check or deposit slip from your checkbook.

- Click Continue.

In 2-3 business days, OlyFed will make two small deposits and one withdrawal from your external account. Once you receive those transactions, log into OlyFed online banking and navigate to Menu > Services > Verify External Account. Once you have entered and verified the deposits, you can begin transferring funds to and from the account.

Note: New online banking customers will not have External Transfer capabilities during the first 60 days after enrollment.

Verifying an External Account

- Login to digital banking.

- In the Services > Verify External Account.

- Select the account you would like to verify.

- Enter the amounts of the 2 micro-deposits that have been made into your external account.

- Click Continue.

Can I enroll on a mobile device?

Yes, you can enroll in online banking through your mobile device by downloading the OlyFed Mobile app and clicking the Enroll link. Once the enrollment process has been completed you can use the Login ID and password to access your accounts via mobile and online.

Apple App Store Google Play Store Personal Online Banking Business Online Banking

How long does it take to have funds available after I deposit a check with mobile check deposit?

Checks accepted before 4 p.m. (PST) on a business day will be available at midnight. Checks accepted after 4 p.m. (PST) will be available the following business day at midnight.

Note: New customers to OlyFed will have a 15 business day hold on all Mobile Check Deposits during the first 30 days the account is opened.

Note: Checks will not be deposited on the weekend or federally observed holidays.

What do I need to write on my check to have it accepted in mobile check deposit?

Endorse the check with your signature and write “For OlyFed Mobile Deposit Only”.

What is the daily limit on depositing through mobile check deposit?

Limits are based on the length of the account relationship and your account activity.

Who do I report outages or other system issues to?

For assistance, please contact Digital Services at (360) 596-9512 or by email.

Can I change my password/login ID?

Yes! When you need to, you can change your password within online banking. We recommend that you change your password regularly and use a unique login ID and password unused on other websites.

- Login to digital banking.

- Navigate to Settings > Security Preferences.

- Click Change Password.

- Enter your current password.

- Create a new password.

- Reenter your new password.

- Click Change Password.

Changing a Login ID

- Login to digital banking.

- Navigate to Settings > Security Preferences.

- Click Change Login ID.

- Enter your new login ID.

- Click Save new Login ID.

Can I change my address online?

Yes, if you current address ever changes and you need to update your contact information, you can submit an address change within online banking.

- Login to digital banking.

- Navigate to Settings > Address Change.

- Choose the account(s) that need the address change.

- Update your contact information.

- Click Submit.

Note: Address will only be updated for the person submitting the request. To update for additional joint owners, please send a secure message* to Digital Services Support. *Secure Message is within online banking not confidential email.

How do I turn on Touch ID or facial recognition for the OlyFed Mobile app?

With this feature enabled, you can now easily and securely sign in to your digital banking using Touch ID or Fingerprint Login on our mobile app!

- Login to your OlyFed Mobile app and tap the Menu button.

- Navigate to Settings > Security Preferences.

- Toggle the Touch ID or Fingerprint Login switch from Off to On.

- Review the information about using fingerprint authentication and tap Continue.

- Enter your login ID and password and tap Authorize.

- Scan your fingerprint.

- iOS Device: Place your finger on the Home button to enable Touch ID.

- Android Device: Place your finger on the fingerprint scanner to enable Fingerprint Login. The location of the scanner varies from device to device.

Note: You must have Touch ID or Fingerprint enabled on your mobile device before enabling it through the OlyFed Mobile app.

Do you offer text banking?

Yes! Once enrolled, you can check balances, review account history and transfer funds from your accounts using any text-enabled device. Visit our interactive user’s manual to review the commends for text banking. They can also be found under Services > Text Enrollment.

- Login to digital banking.

- Navigate to Services > Text Enrollment.

- Toggle the Text Enrollment switch from off to on.

- Enter your SMS text number (226563)

- Read the Terms & Conditions and check the box next to Agree To Terms.

- Click Save when you are finished.

- Click Visit Preferences to be taken to the Accounts feature.

- Select an account you want to enroll in text banking.

- Click the SMS/Text tab.

- Toggle the SMS/Text Enrollment switch from off to on.

Note: Once you’ve signed up for Text Banking, you should receive a text confirmation.

What do I need to enroll in digital banking?

You will need:

- Social Security Number or Tax ID Number

- Last Name

- Date of Birth

- Zip Code

- Desired Login ID

I received an alert that my password changed, but I didn't change it. What do I do?

For immediate assistance, please contact Digital Services at (360) 596-9512 or email to report the alert.

Why is the amount in “pending activity” in digital banking higher than the amount I signed for when using my debit card?

Some merchants may estimate your final bill and request authorization for this higher amount. The authorization will reduce your available balance until the final transaction from the merchant is processed (typically 2-3 days).

Can I set up alerts for account activity through digital banking?

Yes, Alerts can notify you via email, text or secure message for balance changes, online activity and transactions. There are also optional Security Alerts.

- Login to digital banking.

- Navigate to Services > Alerts.

- Click + New Alert and select an alert type.

- Follow the prompts for the alert.

- Select a delivery method.

- Click Create Alert.

Why did I get locked out of digital banking?

For your security, access will become locked after repeated entry of an incorrect password. Contact Digital Services at (360) 596-9512 to be re-enabled.

What devices are supported by digital banking?

In order to receive a secure and ideal digital banking experience, please review this information about hardware and software requirements and browser support recommendations.

Can I make multiple payments at once in bill pay?

Yes, you can pay as many bills as you need in one session. Bill Pay with OlyFed allows you to stay on top of your monthly finances. Having your bills linked to your bank account enables you to electronically write checks and send payments in one place.

How do I make an external transfer?

OlyFed offers External Transfer which allows you to transfer to and from other banks, credit unions and brokerage firms.

- Login to digital banking.

- Navigate to Transactions > Funds Transfer

- Use the from and to drop-downs and choose the accounts to send and receive the funds.

- Enter an amount to transfer.

- Click Transfer Funds.

External Transfer Limits

- Daily: $10,000

- Monthly: $40,000

NOTE: Funds transfer activity can be review in the Digital Activity Center under Transactions. New online banking customers will not have External Transfer capabilities during the first 60 days after enrollment.

What should I do with my check after I deposit it through Mobile Check Deposit?

We recommend keeping your check for 45 days to ensure that the check clears successfully.

Can I download transactions into Money Management programs?

Yes, our online banking is compatible with Money Management programs including Mint, Quickbooks, Quicken and others. We recommend downloading transaction history monthly to keep your accounts and software up to date.

Home Loans

How difficult is it to manage the custom construction process?

The idea of building the home of your dreams is an exciting endeavor; however, it can be an intimidating process leaving you stumped on where to begin and what to expect.

To help you bust the seven biggest myths of building and to give you the tips, tools and confidence to start the construction process today, we’ve put together this helpful video that will answer your questions and put you at ease.

How do I review my credit score?

SavvyMoney™ is a tool to keep track of credit score reports and provides credit monitoring, alerts, personalized offers and expert insight on how to improve and strengthen your credit. It is a free service provided to our customers through our digital banking platform.

Utilizing VantageScore 3.0 from Transunion, you’re able to check your credit score anytime and anywhere to help you make better financial decisions. Utilizing the services will never directly impact your credit score. When accessing your credit file information, it results in a “soft inquiry” that doesn’t alter your score in any way.

Utilizing VantageScore 3.0 from Transunion, you’re able to check your credit score anytime and anywhere to help you make better financial decisions. Utilizing the services will never directly impact your credit score. When accessing your credit file information, it results in a “soft inquiry” that doesn’t alter your score in any way.

Customers can enable this feature by clicking on “Credit Score” within the left-hand Main Menu or by clicking on the widget on the right-hand side of the screen. This feature is available for both desktop and mobile users.

Questions? Email us, call (360) 754-3400 or visit a branch.

Do you offer customized repayment plans?

Your loan officer will work closely with you to help you find a loan program that has a repayment plan to fit your budget.

Does OlyFed Fund Accessory Dwelling Units (ADUs)?

Yes, we do! We’re one of the only banks in the area with a dedicated plan for funding ADUs.

We offer six loan options and can help you decide which works best for your financial outlook and the amount of equity in your main house. Many of our loan options can include the value of the ADU in the loan appraisal, providing greater borrowing power.

Do you offer loan modifications?

Yes. Please contact one of our loan officers at (360) 754-3400 to get the process started.

What is a Portfolio Lender?

A portfolio lender is a bank that originates mortgage loans and holds them for the life of the loan instead of selling them in the secondary market. OlyFed is a portfolio lender.

What things do I need to provide to get pre-qualified for a home loan?

We can start the pre-qualification process for you by asking a few simple questions, but the following items will help us with the pre-qualification process for your loan:

–Social Security Number for all borrowers who are listed on the mortgage loan.

–Date of Birth for all borrowers who are listed on the mortgage loan.

–Address information for current and previous two years. If renting, we will also need a name, address and phone number for the landlord.

-Employment Information including employer’s name, mailing address and phone number for the last two years.

-Proof of Income to include one month of pay stubs and two years of W2s for all borrowers who are listed on the mortgage loan.

If you are self-employed, you will be asked to provide two years of tax returns. Approximate Total Debt and Minimum Payment Amounts.

What is the Fair Lending Act?

The Fair Housing Act (FHA) and the Equal Credit Opportunity Act (ECOA) protect consumers by prohibiting unfair and discriminatory practices.

FHA prohibits discrimination in residential real estate related transactions based on race or color, national origin, religion, sex, familial status, handicap.

ECOA prohibits discrimination in credit transactions race or color, national origin, religion, sex, marital status, age, applicant’s receipt of Income from a public assistance program, or whether a person exercises rights granted under the Consumer Credit Protection Act for any credit transaction and through the life of the loan.

When will you perform a credit check?

Generally, we will pull your credit at the beginning of the loan application process.

What is the difference between the interest rate and annual percentage rate?

The interest rate is the cost of borrowing the principal loan amount. The annual percentage rate is a broader measure that factors in the fees charged by the lender.

Are their special deals for first-time home buyers?

We offer discounted interest rates and fees for first time home buyers. For details, please speak with one of our knowledgeable and caring loan officers by calling (360) 754-3400.

How much of down payment is required on a home loan?

We have many different loan programs available, some of them requiring as little as 3% down.

Do you offer down payment assistant programs?

While we do not have a down payment assistance program, we do offer an Affordable Home Buyer Program. This is a special loan program for potential borrowers with earnings at 80% or less of the median income levels in Thurston and Mason counties.

Applicants can borrow up to 97%* of the purchase price of a home and all but $1,000 of the down payment may come from a family gift or down payment assistance program. In addition, seller paid closing cost is allowed.

Borrowers who qualify for this program receive a discounted interest rate based on current market rates. In addition, qualifying borrowers also receive a reduced loan origination fee, from the typical 1% to a flat fee of $800.00.

All of these special incentives and discounts combine to help reduce the out-of-pocket expenses for the borrower, while also lowering their overall monthly payment.

It’s important to note that this program is for purchases or non-cash-out refinancing. If a borrower is refinancing they need to have owned their home for a minimum of 24 months. The maximum loan amount for this program is $410,000*.

*Subject to approval. Loans with less than 20% down will require approval of Private Mortgage Insurance (PMI). OlyFed has negotiated a discounted PMI premium for qualifying borrowers to help further lower their monthly payment.

What are origination fees?

An origination fee is a fee charged by a lender on entering into a loan agreement to help cover the cost of processing the loan.

Is there a prepayment penalty?

There are no prepayment penalties on our mortgage loans, home equity loans or home equity lines of credit.

How do I determine my monthly payment?

Your monthly principal and interest payment is based on the loan amount and the term of the loan.

What are the costs I'll need to pay at closing?

Your closing costs may include loan origination fees, appraisal fees, title searches, title insurance, surveys, taxes, recording fees and credit report charges.

What loan programs to you offer?

We currently offer a variety of Home Loans at a term of 15, 20 or 30 years for purchases, refinances and construction for both owner-occupied and investment properties; a variety of options for home equity loans and lines of credit; lot loans; speculative loans. We also offer an affordable home loan program and a first-time home buyer program.

Do you guarantee on-time closings?

We work closely with our customers, loan officers and real estate agents to be able to meet all of their expectations for closing dates.

What is LTV?

LTV stands for loan to value. It is a ratio that is calculated by taking the loan amount and dividing it by the value of the home. This is how we determine how much equity you have in your home.

What is the difference between fixed and adjustable rate mortgages?

A fixed rate mortgage has an interest rate that will remain the same throughout the life of the loan.

An adjustable rate mortgage loan has an interest rate that can change throughout the life of the loan. Sometimes the adjustment will occur one time and other times it could occur multiple occasions throughout the life of the loan. Often times, adjustments will be dependent on market conditions at the time that the adjustment is made.

What does it mean when people pay for points to decrease their interest rate?

Mortgage points, also known as discount points, are fees paid directly to the lender at closing in exchange for a reduced interest rate. Olyfed does not have a program in place to allow borrowers to purchase points.

How do you get a permit to build?

In order to get a building permit, you will need to file a permit application with the city planning department in the municipality where the project will occur. Most applications will also require that you submit drawn plans showing the work that is to be done and pay a permit fee.

Do you offer a mortgage checklist?

Yes. Please download our checklist PDF. If you have questions, call (360) 754-3400 to speak with one of our knowledgeable and non-commissioned loan officers.

What is mortgage insurance?

Private Mortgage Insurance (PMI) is a type of insurance you may be required to pay when you take out a home loan and make a down payment less than 20%. The insurance protects the lender for at least some of the shortfall if the home is sold in foreclosure for less than the outstanding amount of the mortgage.

What are my total fees and when will I have to pay them?

The total fees that you will pay will vary depending on the loan program that you choose and the loan amount.

How long does the loan process usually take?

Typically the loan process will take approximately 30 days. We have an amazing loan team in place to be able to meet your deadline.

Can I manage my own construction project without hiring a contractor?

Yes, you can manage your own construction project. Our Loan Officers can help guide you through the construction loan process to help prepare you to be your own construction project manager.

Our BUILT application tool provides real-time collaboration with OlyFed for faster draws and simple budgeting. By eliminating paper, email threads and multiple calls, this web-based system can help you stay on-budget and on-time.

Personal Loans

How do I review my credit score?

SavvyMoney™ is a tool to keep track of credit score reports and provides credit monitoring, alerts, personalized offers and expert insight on how to improve and strengthen your credit. It is a free service provided to our customers through our digital banking platform.

Utilizing VantageScore 3.0 from Transunion, you’re able to check your credit score anytime and anywhere to help you make better financial decisions. Utilizing the services will never directly impact your credit score. When accessing your credit file information, it results in a “soft inquiry” that doesn’t alter your score in any way.

Utilizing VantageScore 3.0 from Transunion, you’re able to check your credit score anytime and anywhere to help you make better financial decisions. Utilizing the services will never directly impact your credit score. When accessing your credit file information, it results in a “soft inquiry” that doesn’t alter your score in any way.

Customers can enable this feature by clicking on “Credit Score” within the left-hand Main Menu or by clicking on the widget on the right-hand side of the screen. This feature is available for both desktop and mobile users.

Questions? Email us, call (360) 754-3400 or visit a branch.

If I have a co-borrower on my application, will their credit be checked?

Yes, a hard credit report is pulled for both applicants. Please see additional information included in the Disclosures section at the bottom of the application. Please be sure all applicants’ credit files are unlocked before applying.

Can I include my spouse’s income on my application?

To include your spouse’s income they must be a co-borrower on the loan.

Should I include the cost of utilities in my Monthly Housing Expense amount?

No. For Monthly Housing Expense, only include the amount of your rent or mortgage payment.

If I receive child support, do I need to disclose it as Other Income?

Only list alimony, child support or other separate maintenance payments if you will be using them for repayment/qualifying. Otherwise, you do not need to list these payments.

After I submit my application, how long does it take to get approved?

Once you submit your application, you will receive a confirmation email and your application will be reviewed within one business day. Then we will contact you with the status of your application and the next steps. If you have questions, we’re here to help! Give us a call at (360) 754-3400 or email us. Representatives are available Monday – Friday from 8:30 a.m. – 5:30 p.m. (For information on individual location closures or delays, please visit the locations page.)

After I submit my application, how do I find out if I’m approved?

Your application will be reviewed within one business day and you will be notified by one of our representatives of the status of your application and next steps. You may also log in to view the status of your application using your user name and password that was created at the time of the application.

If you have questions, we’re here to help! Give us a call at (360) 754-3400 or email us. Representatives are available Monday – Friday from 8:30 a.m. – 5:30 p.m. (For information on individual location closures or delays, please visit the locations page.)

What will my interest rate be?

The Annual Percentage Rate (APR) will be determined based on a variety of factors. If your loan request changes during the application process as it relates to the amount, length of term, collateral value, model year or down payment/trade-in value, your rate could change from our original quote.

How will I get the funds for my loan?

Depending on the type of loan, you may have the option to have your funds disbursed into your account or via an official check from a branch.

What is the loan term?

How long of a loan do you want? Typical loan terms vary from 12-72 months, however, longer terms are available based on your loan program and collateral type.

What documents do I need if I am approved?

A representative will reach out to you with a list of documents needed to complete the loan process. These items can change depending on your loan type. You may also give us a call at (360) 754-3400. Representatives are available Monday – Friday from 8:30 a.m. – 5:30 p.m. to answer any questions. (For information on individual location closures or delays, please visit the locations page.)

You may also log in to view required documents by using your username and password created at the time of application.

Once my loan request is approved how much time do I have to complete the process?

Loan applications are good for 30 days from when credit is pulled.

What is GAP insurance?

If your car is totaled for any reason, the amount of reimbursement you receive from your insurance company may be substantially less than the amount you owe on your car loan. Unless you’re covered by gap insurance, this financial shortfall or “gap” could leave you owing thousands of dollars.

What types of personal loans does OlyFed offer?

We offer auto, recreational vehicle (RV), tiny home vehicles, boat, home equity line of credit, personal line of credit loans, non-title eliminated manufactured homes and co-op loans.

Business

Do you offer a business online banking tool?

Yes! Whether your business is a sole proprietor, a non-profit, a corporation or anything in between we have an online banking solution for you.

What do I need to open a business account?

This PDF document outlines all the information and paperwork you will need to bring with you to open your business account. You can also call or email us if you have any specific questions.

Do you have a checking account for non-profits?

Yes, our Outreach Checking account is specifically designed for our local non-profit organizations, neighborhood associations, churches, special interest groups, service clubs and professional associations.

Are there pre-payment penalties on your loans? What about term length and amortization?

We know all businesses have unique needs, which is why all terms and conditions with our loans are negotiated directly with Business Banking specialists. It’s just another example of the power of banking local.

Do you offer business credit cards?

Yes, we partner with Elan Financial Services to provide you with a wide variety of business credit card options, which provide you with the rewards and flexibility to meet your goals, needs and strategies. Click here for our online application.

Do you offer Business Savings or Money Market options?

Yes, we offer both Business Savings accounts, as well as Premium Money Market accounts, for business customers. These accounts provide security for your reserve funds while providing both a competitive interest rate and the flexibility you need to access your money on short notice.

Do you offer a Health Savings Account (HSA) to help my employees with their high deductible health plans?

Yes, we offer a no-fee Health Savings Account (HSA) that provides a tax-free way to save and pay for qualified medical expenses. This account even provides a competitive interest rate and its own debit card for ease and convenience of payments.

Do you have the ability to export my online banking information to Quickbooks?

Yes, our online banking is compatible with Money Management programs including Mint, Quickbooks, Quicken and others. We recommend downloading transaction history monthly to keep your accounts and software up to date. If you require assistance, please contact small business banker, Aron Dowell.

Do you offer payroll services?

Our online banking platform allows you to create and send payroll through ACH. However, it does not have functionality for withholding and transmitting funds to government entities. For more information on ACH services please contact our Small Business Banker, Aron Dowell.

Do you lend to small businesses? Are you an SBA approved lender?

Yes, we offer all types of business loans to someone who is operating their business in Thurston and Mason Counties. Give us a call at (360) 754-3400 so that we can learn more about how we might be able to partner together help you achieve your unique goals. We are here to help and adept at both the SBA 7(a) and SBA504 programs.

Do you have any business resources?

Yes, we consistently refer individuals to the Center for Business & Innovation, located at the Thurston Economic Development Council on the SPSCC Lacey campus.

You can also use resources provided by the Small Business Administration.

Can you help me buy real estate for my business to occupy?

Yes, we can help with that, give Carrie Whisler a call at (360) 754-3400.

I would like to own commercial real estate as an investment, can you help me?

Yes, we can help with that, give Chuck Hoeschen an email or call at (360) 754-3400.

I need to accept credit cards at my business and also when I’m out of the office, can you provide a solution?

Yes, we are partnered with Select Bankcard, to provide a comprehensive suite of user-friendly payment systems to efficiently manage your transactions and cash flow. Please contact one of our Universal Bankers to get started.

Deposit Accounts

How do I stop payment on a check?

To place a stop payment on a check or an ACH debit transaction, call or visit your local branch. You can also initiate stop payments through online banking.

What routing and bank information do I need for a domestic wire?

This information is used for domestic wires.

Receiving Bank Name: Olympia Federal Savings

Receiving Bank ABA: 325170822

Receiving Bank Address: 421 Capitol Way S, Olympia, WA 98501

If you have questions or need help, please contact us.

What routing and bank information do I need for an international wire?

This information is used for international wires when the sending bank identifies a US correspondent bank.

Receiving Bank Name: Olympia Federal Savings

Receiving Bank ABA: 325170822

Receiving Bank Address: 421 Capitol Way S, Olympia, WA 98501

If the sending bank requires a Swift code, you may use the information for Convera UK Limited. Convera will receive the wire from the international bank and forward it to us for final crediting. Convera will deduct a small processing fee from the wire before sending it to OlyFed when this option is used.

Convera UK Limited / Swift Code Information

Receiving Bank Name: Barclays Bank PLC

Receiving Bank SWIFT: BARCGB22

Sort Code: 200605 (if required)

Receiving Bank Address: 1 Churchill Pl, London E14 5HP, United Kingdom

Beneficiary Name: Convera UK Limited

Beneficiary Account #: GB44BARC20060559882600

Beneficiary Address: Alphabeta, 14-18 Finsbury Square,1AH – Part 3rd Floor, London EC2A, United Kingdom

Originator to Beneficiary Information must be included:

F/C to Olympia Federal Savings

For benefit of {insert customer’s name and account number here}

If you have questions or need help, please contact us.

What is a direct deposit?

A direct deposit is any payment that you receive from a person or organization directly into your account. These include payroll direct deposits, government direct deposits (Social Security, Disability, etc.) and dividend direct deposits from investment accounts.

What is an automated payment?

An automated payment (or ACH) is a regular, ongoing electronic funds transfer, such as a monthly insurance bill, utility payment, or automobile loan payment.

What is an Association Bank Check?

An Association Check, is issued and guaranteed by the bank. When a checking account holder obtains a bank check, the bank removes the specific amount of money from the payers account and moves it into a separate account. Since the money is taken directly from the payer’s account and set aside for the recipient, a bank check cannot bounce. Bank checks have no dollar limit and are available only to OlyFed customers.

Where are your ATMs located?

OlyFed has ATM’s at all 8 of its branch location; however, and more importantly, we are part of the ATM Money Pass Network, which provides our customers with access to more than 40,000 surcharge free ATM’s nationwide.

Can I open a checking account online?

Yes, you can open both a Freestyle and Journey Checking account online. Click here to view all accounts that can be opened online.

Do you provide Notary Service?

Yes, this service is provided free of charge to our customers only. Notarization is a written statement, or certification, in which the Notary Public has positively identified the party or parties who signed the document.

Do you have a night deposit drop?

Yes, each branch has a night deposit that is available for your use. The night deposit allows you to make deposits after-hours that will be credited to your account on the follow business day. Receipts are mailed for every deposit made to the night deposit. OlyFed does not charge a fee for this service.

Do you offer wire transfers and what are the limits?

Yes, this is an electronic transfer of funds from one financial institution to another. You are able to send a wire transfer for up to the amount of collected funds in your account. There are no limits to the number of wire transfers that you may send.

Initiated by the customer from the sending institution, a wire transfer is a quick, safe way to transfer funds between institutions.

See account fees for more details.

Do you offer Safe Deposit Boxes?

Yes, we offer Safe Deposit Boxes to customers and non-customers alike. The boxes are located in every branch. Sizes and availability may vary from branch to branch. Customers are billed yearly on June 1st for their rental.

How to I order checks for my account?

Re-ordering checks is a breeze at OlyFed. Enjoy multiple options for re-ordering checks, deposit slips and accessories. Re-order checks online, in person at your nearest branch or by calling (360) 754-3400. To order online, navigate to Services > Check Reorder.

Note: First-time check orders must be placed in person or by telephone.

Do you offer overdraft protection?

Yes, this service is available to customers to help cover checks or electronic funds transfers that may clear against an insufficient balance in their checking account. This service directly ties a checking account to a savings, money market or second checking account. OlyFed does not charge a fee to set up this service. There is a $5 fee per Overdraft Protection transfer.

What fees do you charge on your checking accounts?

For a full list of our account fees, click here.

What do I do if my debit card is lost or stolen?

To report a lost or stolen debit or ATM card during regular business hours, please call OlyFed at (360) 754-3400 or report it at any branch. After hours, please call 1-800-472-3272.

Where is my routing number on my check?

At the bottom of your check, you will see three groups of numbers. The first group is OlyFed’s routing number, the second is your account number and the third is the check number.

OlyFed Routing Number: 325170822

Is there an easy way to transfer my accounts to OlyFed?

Switching to OlyFed has never been easier with ClickSWITCH, which allows you to digitally transfer your direct deposits and automatic payments in just a few minutes with just a few clicks of your mouse.

How can I add a signer on my account?

You can add a signer to any of your accounts by visiting any of our convenient branch locations and having one of our helpful bankers assist you in adding this person to your account. Please be sure the person you are adding brings with them a government id, along with their social security number.

How do I view my checking account activity?

Our mobile and online banking systems provide accurate and up-to-date information on all your account activity. Sign up for online banking today.

How do I choose the best checking account for me?

Our personable, caring and knowledgeable bankers are here to help you decide what account will work best for your financial needs and lifestyle. Or visit our Checking page which provides a helpful comparison chart, which also outlines the features and benefits of each account.

Is the money in my checking account insured?

Do you have a free checking account?

Yes, we have three free checking accounts. Our Freestyle and Journey accounts offer a host of features, benefits and banking options for today’s on-the-go lifestyle. We also offer our free Jump Start checking account for youth under the age of 19.

Easy Switch

What is Easy Switch?

Easy Switch makes it easy for you to quickly and securely switch your current online bill payments, automated payments and direct deposits from your existing financial institution accounts to your OlyFed account. It removes the hassles of contacting all your billers to make changes.

How does Easy Switch work?

Easy Switch removes the hassle of moving your automated payments and direct deposits to your OlyFed account. You input your payment and direct deposit information into our secure Easy Switch system and we’ll get to work contacting all the billers to switch your payments over to your new account. You can monitor progress and track status in the “Status” column.

What do I need to start the Easy Switch process?

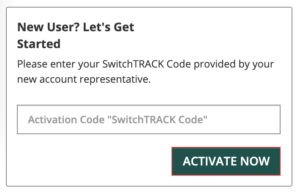

Getting started is easy! Login to online banking and click on Easy Switch or use the SwitchTRACK code provided to you by your bank representative. You’ll need to gather your automated payments and direct deposit information to begin. A previous statement is a great source of information on the automated payments and direct deposits tied to an account.

Where do I get a SwitchTRACK code?

Call 360-754-3400 or come by a branch during operating hours to receive your SwitchTRACK code. If you opened your account online, please reference the Easy Switch documents for details and instructions, including your SwitchTRACK code.

How long will it take for me to switch my payments?

Timing for each payment switch can vary depending on the type of payment, biller, and the method needed to switch the payment. Online banking bill payments are switched instantly. Automated payments and direct deposits typically take between 7-10 days to switch but can be faster with certain billers. It’s always a good idea to review your switch status page for the most current information regarding each switch.

Do I need to call my billers to confirm the switch?

We display the status for each automated payment or direct deposit in the Status column. If a switch shows as “Completed” there’s no need to contact the biller. For switches that are marked as “Mailed” for more than 10 days, you may want to contact the biller to confirm the status.

Does Easy Switch work with direct deposit?

Yes. Indicate the type of direct deposit you want to switch and complete the required information.

Please note: some employers and government agencies require direct deposit switches to be completed directly with them. In these cases, you may need to reach out to them directly.

What should I do if a switch still shows as mailed?

Automated ACH payments may take up to 10 days to switch. If your switch has a “Mailed” status for more than 10 days, it’s a good idea to contact the biller to confirm the switch or to see if the biller needs additional information.

One of my switches has an “Action Needed” status. What does this mean?

Occasionally, after you have submitted a switch for processing, our research team determines that a particular biller requires you to update your banking information with them online. When this happens, your switch will show an “Action Needed” status. To see the details of the action you need to take, you can click on the Edit icon in the Actions column.

Why do I need to enter my billing account number?

Your billing account number is required by the biller to ensure your identity and to update the account information in their system.

Which address should I use for my biller?

A number of billers are included in our system. If we do not have a biller’s address, please use the address that is indicated on the payment confirmation or statement the biller sends you. You can also find most billers’ payment addresses displayed in the Help or Contact Us areas of their websites.

How do I know my payment has been switched?

The easiest way to check the status of a switch is to look at the “Status” column of your Easy Switch account. Switches that have been completed and confirmed by your biller will display a “Completed” status. Switches that are still in process will display a “Mailed” status.

Can I switch a payment if I don’t have the billing information?

You need at least some billing information to switch the payment, as billers require certain information to confirm your identity and complete the switch. Your name, biller’s name and account number are required. For some billers, an address and phone number will populate automatically; however, if the biller is not in our database, we’ll need you to provide the biller’s address and phone number as well.

What if I want to submit additional switches later?

You can easily add additional switches at any time! Simply log back into your Easy Switch account and resume your session.

What if my switch isn’t completed and I miss a payment?

Monitoring your switch status is an important part of moving your account. It is advisable to keep enough money in your old account to cover each payment until the switch status for that payment has changed to “Completed,” or you’ve confirmed with your billers that your payment account information is updated in their systems.

My SwitchTRACK code isn’t working. What should I do?

Please contact your personal banker, call 360-754-3400 or visit a branch for assistance with your SwitchTRACK code.

Is Easy Switch secure?

Yes! Easy Switch uses the latest in online encryption protection to gather and store your switch information. Additionally, our mailing facilities adhere to the highest industry standards with regard to security of your personal information.

What is an automated payment?

An automated payment (or ACH) is a regular, ongoing electronic funds transfer, such as a monthly insurance bill, utility payment, or automobile loan payment.

What is a direct deposit?

A direct deposit is any payment that you receive from a person or organization directly into your account. These include payroll direct deposits, government direct deposits (Social Security, Disability, etc.) and dividend direct deposits from investment accounts.

How should I gather the payments that need to be switched?

Easy Switch will help you switch all of your automated payments. Simply gather your paper bills or online statements that include the billers’ names and addresses, account numbers with your billers and due dates. This is all the information you need to start the switch process!

When is it safe to move/remove funds from my prior account?

We recommend keeping enough money in your old account to cover each payment until the switch status is “Completed.” This is especially important for any payments that might be due during the 14 days after you initiate a switch.

I’m having technical difficulties. Who should I contact?

Please contact your personal banker, call our main number 360-754-3400, call Digital Services at 360-596-9512 or visit a branch during operating hours. We’re happy to help.

Where do I sign in with my personal SwitchTRACK code?

Once you’ve been given a switch code by your personal banker, you log into the OlyFed ClickSWITCH portal and enter it to begin.

Careers

What are your employee benefits?

There are many benefits of working with OlyFed! We’ve listed over a dozen on our Careers page. There is also a link to view job listings!